With the recent addition of QRC technologies to the Parsons portfolio and our record and playback signals capabilities, I often get asked, “When will 5G rollout to the masses, what does that exactly mean, and what is Parsons doing to address some of the upcoming challenges for its clients?”

As we have all been exposed to in the media, the marketing promotion of “5G” has become its own ‘brand’ in the mind of consumers; well at least in the view of the popular press. Cellular phone manufacturers and providers have piled on, promoting their upcoming devices and creating promotional materials around the “awesomeness” of 5G.

There have also been cases in the U.K. where individuals have taken to burning down 5G cell towers as they perceived the towers to be contributing to the spread of COVID-19. So, with all this media attention what is the present status of operations and deployment of 5G around the world?

5G Network Variants

In basic terms, 5G refers to a telecommunications protocol that uses a new radio (handset) and a new core network. It also involves a framework that will enable many new services due to its ability to accommodate higher data throughputs. 5G is taking off faster than any previous mobile technology. Historically, the cycle for deploying new cellular standards, such as 2G, 3G, and 4G occurred over multiple years.

The 5G standards are being rolled out much quicker, partly to continue to drive consumer device sales and partly to enable those devices to take advantage of various infotainment offerings, to enable the next level of virtual and augmented reality products and services, cloud-assisted driving, and cloud radio access network (C-RAN); in brief to push core cloud capabilities to the edge.

There are two network variants of 5G that are being fielded; Non-Stand-Alone (NSA) and Stand-Alone (SA). The 5G deployments to date have been of the NSA variant. These systems are designed to rely on LTE (“4G”) for their control channels. In other words, only when a device to exchange large amounts of data, the LTE system would assign the user equipment to the 5G NSA carrier.

While 5G NSA networks will be deployed for the years to come, 2020 will see the first 5G Stand Alone (SA) network deployments. 5G SA networks are self-sufficient cellular networks that do not rely on LTE. As such they contain all the functions of mobile control and idle mode management as previous cellular generations of cellular protocols do.

4G and 5G will co-exist much longer than previous generations of cellular protocols and, unlike some other protocols, have common infrastructure. This overlap will provide parallel coverage for both providers and consumers. 4G is provided from large towers that have typical ranges of 20 to 45 miles. 5G uses different spectrum and at the low signal bands can range 50 to 60 miles and at the higher signal bands can range about a third of a mile but provide very fast data rates. From the consumer’s perspective, the parallel coverage approach allows for signal aggregation, whereby one can combine part of the high-band spectrum with the mid or lower band spectrum thus providing a richer experience.

One note to mention is that as cellular providers start to assess their business positions during the COVID-19 period, many are adjusting their roll-out plans in response to the broader economic situation, which may result in a slower roll out of the 5G technology than was previously being promoted.

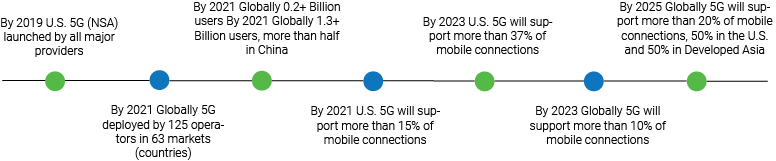

Projected Adoption Rates In The U.S. And Globally

_______________________________________________________________________

____________________________________________________________________________

5G Hype Vs. Reality

We’ve all heard the promises of the huge speed increases that 5G will offer consumers, but how much of that will come to fruition? Currently, the US 5G data throughput is 3 to 30 times faster compared to 4G. However, significant 5G speed increases over LTE (“4G”) are mostly realized by utilizing the millimeter wave spectrum, which is in the 24 GHz range.

The limitation here is distance; as the frequency increases the coverage area decreases, thus the need for having a small base station on ‘every’ street light pole! Indeed, a paper released by the Defense Innovation Board last year cited that approximately 13 million base stations would be needed in the US to deliver 100 Mbps to 72% and 1 Gbps to 55% of the population, respectively, at a cost of $400B in CAPEX.

With that many base stations and investment needed for higher data rates, it begs the question, will competition from new WiFi standards (which are rolling out higher data rates in their standards and already have density) or from emerging commercial satellite startups (offering up to 100 Mbps speeds) change the course of 5G? Post-COVID these two approaches may be on the more level playing field, given the cellular providers’ likely economic pull back on infrastructure deployment and the larger Satcom providers like Google and Amazon’s ability to press forward and continue vertical integration with their other services.

5G And Impacts On IoT

We all know that the first devices with 5G capabilities are mobile phones (multitudes of them are already available) but IoT devices will likely choose their communications technology-based upon application requirements. For example, many of the devices in your home will continue to use today’s WiFi. However, there are several competing standards that IoT devices can use to optimize power usage, bandwidth, or transmission distance, including LoRa/LoRaWAN, Zigbee, and Z-Wave, to name a few. On the cellular side, there are the LTE-M and NB-IoT standards which are designed specifically for machine-to-machine and the Internet of Things. These standards have been designed to coexist with 5G and will be officially folded into the 5G standard with the upcoming 3GPP Release 16.

One of the pillars of 5G is the concept of massive IoT deployment. This concept refers to the enormous number of IoT sensors and devices that will be communicating with one another – ie think “smart cities.” Although we can observe a lot of this technology in our everyday lives today, the IoT landscape is very dynamic and still emerging.

In this space, we see the use of current technologies (such as WiFi and Bluetooth), repurposed technologies (such as 802.15.4 and ultraWideBand) and emerging technologies (such as Connected Home over IP). New use cases and devices are constantly being defined and the ultra-reliability and low-latency communications of 5G will allow for previously impossible technological advances to be enabled, such as self-organizing networks. I expect the trend of diverse signal sets for IoT devices, both standard, and proprietary, to continue given the plethora of options that manufacturers have for integrating communications technology into their products.

The X factor here may be how deep Amazon, Apple, and Google get with their Smart Hubs and integration with Alexa, Siri, and Assistant. Time will tell if consumers turn this into a VHS vs. BetaMax war or simply a perpetual three-horse race.

Our Approach

Regardless of which of these standards end up prevailing, we continue to invest in helping our clients characterize, survey and understand all the complexities between base stations, devices, bad actors, and sometimes, just an inadvertent network misconfiguration or interference issue.

To understand these RF environments, most vendors rely upon vast signal libraries to detect waveforms by utilizing a lookup table methodology. We have taken a different approach by building patent-pending AI/ML algorithms that detect and identify signals using unsupervised learning. The signal detection and identification capability includes frequency agile-based signals and allows for other advanced signal detection and manipulation on man-portable low SWaP (size, weight, and power) devices.

What’s Next

What’s next? Well, we’ve just begun our journey becoming part of the Parsons family and will be coming up on our one-year anniversary in August. We’re hard at work to bring more capability to our customers in an even smaller size, weight, and power envelopes. We’re also well underway combining our signals expertise with the cyber and multi-domain teams at Parsons. Indeed, the future is bright, and I look forward to the capabilities we’ll be able to deliver to our clients in the coming months.