The Rise Of The Whole Life Partnership Model In The Gulf Region

The whole region has experienced wave after wave of capital investments in infrastructure over recent decades. Arguably, the initial catalyst for this was Dubai, with massive investment reaching a peak in the 2000s. The government launched many ambitious projects, including the construction of the world’s tallest building, Burj Khalifa, and the Palm Jumeirah Island. These developments were coupled with transformational investment in modern transportation systems that included an extensive network of highways, bridges, and tunnels to support the continued growth of its economy and population.

Almost immediately following the explosion of infrastructure investment in Dubai was a similar wave of investment in Qatar at the confirmation of its 2022 FIFA World Cup bid announced in 2010. The resulting wave of investment that peaked in the 2010s included three new metro lines, eight major stadiums, and innumerable supporting projects to host one of the world’s largest events and develop the country into a more diverse economic entity. The latest and largest investment in the region so far is now well underway in the Kingdom of Saudia Arabia (KSA), where a change in leadership and investment approach has resulted in the largest infrastructure and building program in recent history.

Maturing Markets

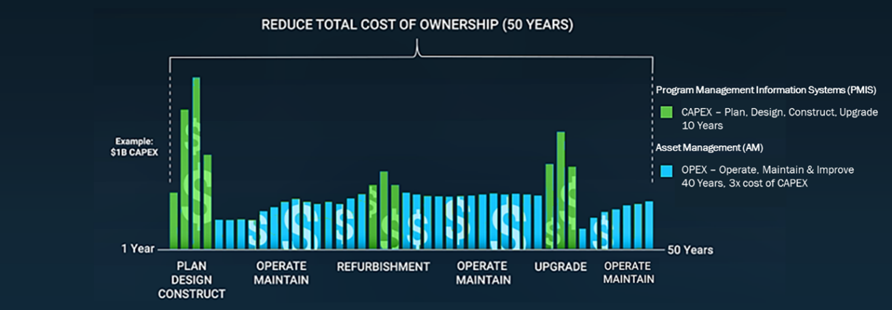

Each of these massive waves of investment has been followed by a maturing of the markets, leading to organizations considering not only capital investment but also longer-term operational and maintenance expenditure. Throughout these developments, our team has played, and continues to play, a leading role. Initially supporting key clients as the delegated representative for their largest capital programs, typically under Project and Construction Management contracts, and more recently in Delivery Partner models. We’re seeing an emerging focus on increased efficiency of whole-life asset management strategies. We believe this holistic view is essential to achieve a whole-life costing approach to capital works, operation, and maintenance, thereby maximizing returns on the huge investments already delivered and still underway. Key examples of these maturity approaches are evidenced in these massive state investment programs.

Dubai

We have supported Dubai’s infrastructure development for decades, with central involvement in many high-profile infrastructure projects. Perhaps the most notable of these projects is the Dubai Metro, where we have managed the design and construction of the metro system as the Road and Transport Authority’s (RTA) Engineer over multiple contracts. From its first public operation in 2009, with rapid adoption and high ridership, the Dubai Metro has been a success and is now established as one of the most advanced public transportation systems globally, helping to transform Dubai into a hub for business, trade, and tourism. Then, as a development of the Dubai Metro, RTA launched a 10-year Operations and Maintenance contract driven primarily by railway regulation and safety. This provided the emphasis on managing the assets to utilize lifecycle value and consideration of handover at the end of the period to either the incumbent or new operator. The philosophy of managing assets in the long term was applied across most of RTA’s assets by adopting an Asset Management Framework and System developed between 2008 and 2011, which delivered benefits such as cost savings, a leaner organization, and enhanced technology at a corporate level.

Qatar

Following the award of the FIFA World Cup in 2010, the expansion of infrastructure grew in Qatar through dedicated capital investment programs. Our team supports some of the most significant and sustained investment programs as a trusted client partner. These programs include Lusail, a whole city development of high-quality, innovative public realm design and construction. Qatar Rail is a 400km long-distance rail network planned in phases to support passenger and freight movements (Network 2030) and several completed and ongoing programs with several clients, including the Public Works Authority (PWA). Similar to Dubai, it was the major public bodies that realized operations and maintenance activities were required to manage the highways network, and consequently, PWA let several contracts during the 2010s. These contracts have developed from ‘Managing Agent’ arrangements and are now considered a Delivery Partner type mechanism where both the consultant and client work hand in hand over an extended period, facilitating sustained investment and innovation. This should provide enhanced service delivery through better customer satisfaction while potentially reducing operations and maintenance costs, which will include consideration of the longevity of the current and future assets.

Kingdom Of Saudia Arabia (KSA)

In KSA, a massive capital development program began in the 2010s and is still ongoing. Our team has been centrally involved throughout, delivering capital works in every region. Born out of this has been a maturing philosophy to not only undertake capital investment but also to develop detailed end state requirements from the beginning of these major programs. A recent example of this is the development of Delivery Partnerships focused on the lifecycle of the project through planning, design, construction, operations, and maintenance. The ‘Shadow Operator’ role provides guidance to the delivery teams and considers the future state requirements from project initiation. This can lead to significant cost savings as the requirements of future assets are built into the design and construction process, and the capex investment is adjusted accordingly in dynamic tension. The same clients are developing Managing Partner roles that utilize long-term contracts to deliver end-state services, again with a change in philosophy from traditional short-term maintenance contracts.

Conclusion

Lessons are being learned as markets mature, and improved approaches are increasingly being adopted in terms of supply chain engagement and whole-life management. This has been evident in the emergence of more value-oriented delivery models of major capital programs to maximize the efficiency of programs and critically to increase the surety of outcomes. In parallel, with a focus on the return on investment of these programs, relatively short-term asset and operations management contracts are being extended significantly to optimize value for clients and better leverage the support of consultants and emerging technologies. These two trends may well fuse into one, with clients seeking the longer-term value of partnerships through the entire lifecycle, from major capital delivery into operation and maintenance, to better realize end-user benefits. This coalescence is only likely to accelerate further with advances in supporting technologies, enhancing data transparency and further optimization of whole-life approaches.